Step 2 of Cultivating Financial Freedom is learning how to create a written budget. If you missed step 1, setting financial goals, click here. Don’t skip the first step! You will need that in order to succeed with the rest. Today it’s all about your budget. The single most important thing you can do to change your financial future is to create a zero-based written budget every payday. We do this every pay because it helps us to stay disciplined with our money and no two paydays (or bills) are ever the same. You have to tell you money what to do or I promise you, it will disappear. A zero-based budget is simply telling every single dollar you earn what to do. Creating a written budget will take a couple of hours, so set aside some time without distractions.

WHERE TO BEGIN

This week, your goal is to sit down with your spouse and take a good look at your financial situation. In order to gain financial independence, you have to face reality and there’s no better time than now. Clear the kitchen table and pull out all of your loan paperwork, bills and debts. Figure out what you owe, including total balances and percentage rates. Next find out where your money is going, after the bills are paid. It helps to look through bank statements in order to get an accurate estimate of how much you are spending on those pumpkin spice lattes. You’ll be shocked to see how much money you’re throwing away on frivolous things.

Organize your spending into 7 categories: Entertainment/restaurants, kids, hobbies, gas, household, food, and other. Look back through at least 2 bank statements or more to get a good picture. You can find this information on your online banking website. The easiest way to estimate your spending is to print out the statements and use a different colored highlighter to cross though each expense category. Once you are done categorizing two or more statements with highlighters, add up each category and divide the total by the number of months you estimated. This represents your current estimated monthly budget. This is reality! You’ll need to get a handle on your high consumption lifestyle and start living below your means, in order to succeed with money. Are you ready to regain control of your financial situation? With the help of your spouse, decide what a realistic monthly budget should be for each category and write those numbers down, then move on to the 5 steps below.

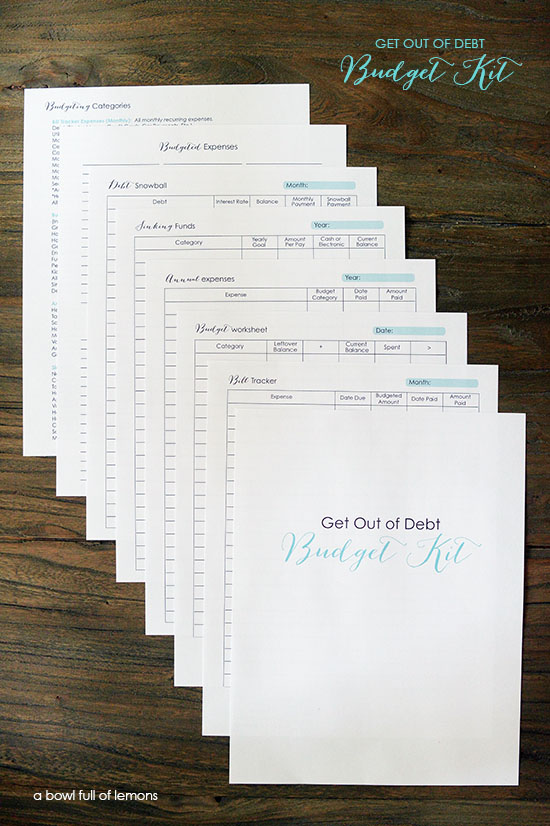

MY WRITTEN BUDGET INCLUDES 5 PARTS:

- Debt Snowball

- Bill Tracker

- Budget Worksheet

- Annual Expenses

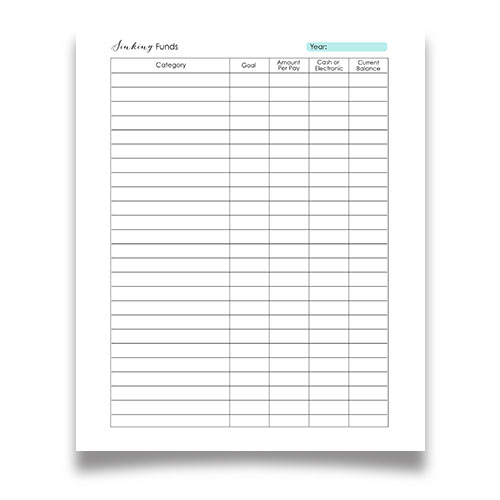

- Sinking Funds

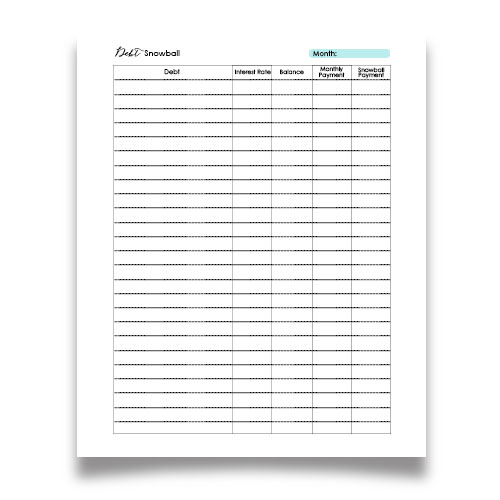

1. DEBT SNOWBALL: The debt snowball form includes a list of all accumulated debt (credit cards, loans, & borrowed money), the interest rates, balances, monthly payments and the snowball payment. To help keep you on track, check out the Debt Free Charts.

When filling out the form, make sure to write down all debts from smallest to largest, not in order of lowest to highest interest rates. To follow the debt snowball method, you will pay the minimum payment on everything but the smallest debt. Use all extra money you earn each month (after calculating your budget) to pay the smallest debt off. Once it’s paid off, add that payment amount to the next largest debts’ minimum payment (snowball effect) and attack it with a vengeance. Continue this pattern until all debts are paid off. To learn more about the debt snowball, click here.

2. BILL TRACKER. A Bill tracker includes all recurring monthly expenses. We have a separate bank account just for our bills. We don’t use it for anything else. We deposit enough money into this account to cover the bills and we pay them electronically through our bank. All of our bills are automatically withdrawn each month, so we don’t forget about them. I highly suggest doing this. You’ll never be late again. If you’re behind on bills, try eliminating the un-necessary ones. The only bills you truly need are housing, insurance, and utilities. Everything else is a bonus. Of course if you are in debt, you have to pay those back.

Using a highlighter, draw a line across the middle of the page. Separate bills by payday. If you pay 5 bills the first payday of the month, they should be at the top of the page and the remaining bills at the bottom. Or you can simply use a separate form for each payday. This will keep you organized.

Using the bill tracker form (or a piece of paper), write down all of your monthly expenses.

- Debts (Student Loans, Credit Cards, Car Payments, etc.)

- Utilities (Water, Electric, Gas, Sewer, Trash)

- Mortgage/Rent (Should not exceed ¼ your monthly income)

- Cell Phone/Home Phone

- Cable/Satellite

- Monthly Memberships (Gym, Clubs, Etc)

- Monthly Subscriptions

- Monthly Insurance

- Monthly Pest Control

- Security System Monitoring

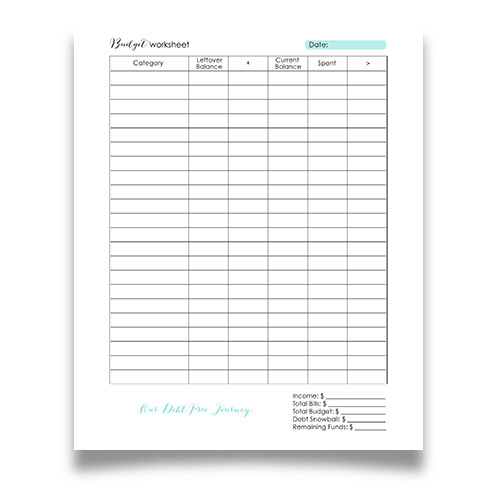

3. BUDGET WORKSHEET. This form includes all (non-bill) expenses and is based on a “cash” budget. You will fill out a new form each payday. Don’t forget to use a pencil, so you can update it when you spend money. I add my sinking fund monthly totals and debt snowball payment to this form each month.

Using the budget worksheet (or a piece of paper), write down your budgeted cash expenses (per payday). You already figured out a realistic monthly budget for the 7 main categories. Figure out how much you need each payday and add any additional categories as needed.

How to use this form: Write each budgeted expense (per payday) in the “category” boxes. The “leftover balance” is anything leftover from last payday, so you can ignore that box until next pay. Add the budgeted amount under the (+) box and write in the same amount in the “current balance” box. Each time you spend money from a category, add the $ to the “spent box” and subtract it from the “current balance”. This may seem tedious but I am living proof that it works and if you stick to it, you will change your habits. Using cash is the easiest way to manage your budget and I do it by using cash envelopes. I’ll show you how to use cash envelopes next week. Keep track of expenses each pay on the “Budgeted & Non-Budgeted Expenses” form.

- Groceries

- Household

- Haircuts

- Gas

- Entertainment

- Fun Money

- Pet Expenses

- Kids Activities & Lessons

- Allowance/Commissions

- Sinking Fund Categories (See below)

- Debt Snowball Amount

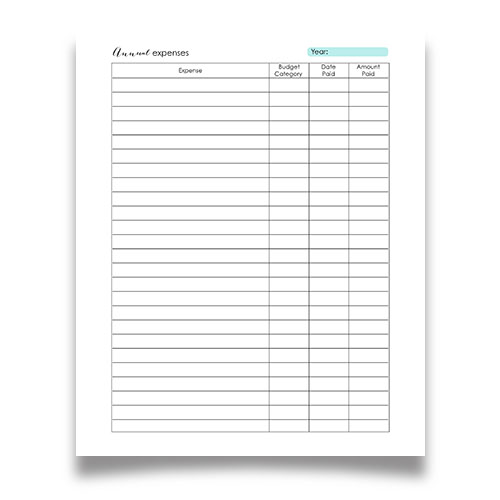

4. ANNUAL EXPENSES. This form includes any expense that does not occur on a monthly basis.

Write down all non-monthly expenses you have paid in the last year. Calculate the cost and consider adding them to a sinking fund. Keep this sheet for your records but use a new one from here on out. As you pay an annual, quarterly, or one time expense, add it to the form. Change out the form yearly.

- Healthcare Expenses.

- Taxes & Fees (Real Estate Taxes, Auto, Federal/State Taxes, Registrations, Etc.)

- School Expenses (Tuition, Books, Fees, Field Trips, Etc.)

- Housing Expenses (HOA, Escrow Shortage, Annual/Bi-Annual Insurance, Termite Inspections, Etc.)

- Memberships & Subscriptions (Annual Renewals).

- Vacations (Total Cost of Trip)

- Auto (Maintenance, Tires, Satellite Radio, Etc.)

- Gifts & Holidays.

- Other

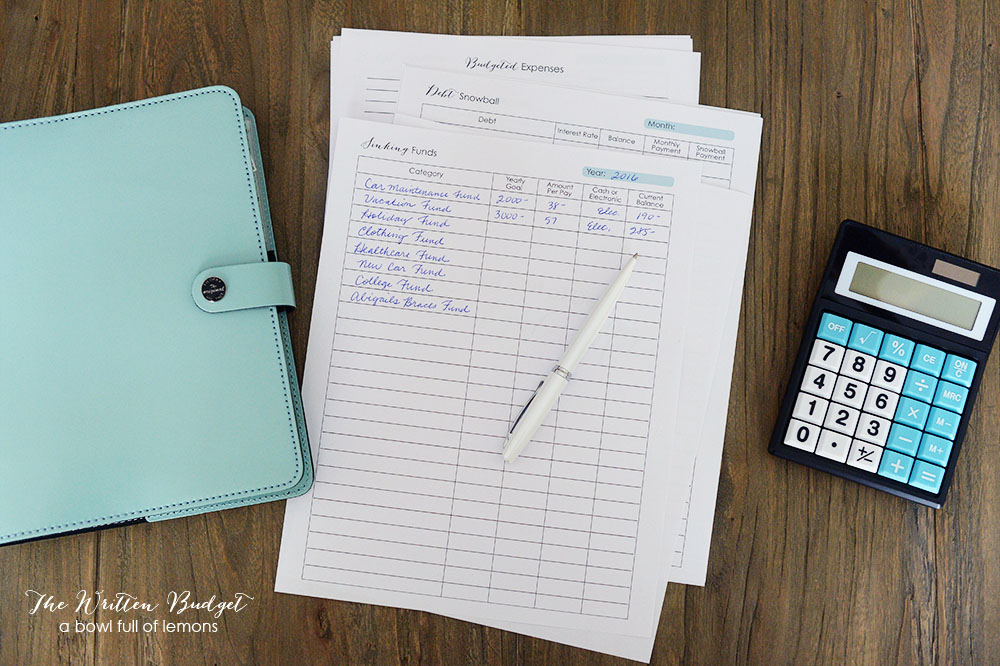

5. SINKING FUNDS. Sinking funds are a fancy name for savings accounts. Everyone should have sinking funds. They are an important part of budgeting. If you don’t have them, you are 100% setting yourself up for failure. There’s no surprise that the money will eventually be due so why not budget for it a little at a time? It’s easy to create savings accounts through your banks website. It takes seconds. Most banks will allow you to create several. I have 12 electronic sinking funds because it keeps me organized, and I know exactly how much I have in each category at all times. I have a separate account for each sinking fund.

To figure out how much to budget for each sinking fund per payday, take your total goal for each category and divide it by the number of paydays per year. Transfer the amount (per category) to your budget worksheet. You may not need all of the sinking fund categories I have listed, so customize them to fit your families needs. Make sure you don’t leave anything out! Once you get paid, transfer the specified amount to each sinking fund account. It takes discipline to build up sinking funds. However if you are determined to get out of debt and clean up your finances, this is a crucial step. You can create “cash” sinking funds as well, if you need to dip into them more often. Be sure to store them away in a locked box.

- New Car Fund. Never make another car payment again. Put money back each payday so that you can pay cash for your next car. If you are in debt, hold off on this sinking fund.

- Car Maintenance Fund (Tires, Oil Changes, Brakes, Car Insurance Deductibles, etc). It’s going to happen so get to saving!

- Taxes Fund If you live in a state that charges personal property taxes, it will sneak up on you in a hurry.

- Housing Expenses Fund (HOA, Termite Inspections, Repairs, etc). These can be costly expenses. Why not be prepared?

- Appliance Fund (Refrigerator, Washer/Dryer, Dish Washer, Vacuum, etc). When your appliance bites the dust, buy a new one with cash. No need to finance if you start saving now.

- Vacation Fund Save throughout the year and eliminate the need to use a credit card. If you are in debt, I suggest skipping this for now, so you can get your debts paid off.

- Healthcare Fund (Co-pays, Prescriptions, Deductibles, Braces, etc). Healthcare expenses are not fun but they are a part of life. Start saving a little at a time now!

- Holidays & Gifts Fund A little at a time makes a big difference in the long run. If you are in debt, minimize spending in this category.

- Clothing Fund (Back to school, etc.). This can get expensive. Be prepared! If you are in debt, consider shopping at thrift stores or garage sales.

- School Fund (Tuition, Books, Fees, School Supplies, Field Trips, etc.)

- Mortgage Down Payment Fund Save yourself thousands of dollars in PMI (Private Mortgage Insurance) by putting down 20% towards your new home. Start saving now. If you are in debt, hold off on this category until your debts are paid off.

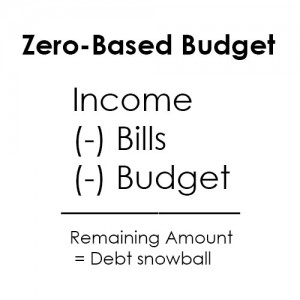

CALCULATE YOUR ZERO-BASED BUDGET:

You’ve figured out your financial situation, including the total debt you owe and the order of your debt snowball. You’ve written down your monthly bills, your cash budget per payday, and your annual expenses. And hopefully you created sinking funds. Now it’s time to put it all together and create a zero-based budget. At the bottom of the bill tracker or budget worksheet, fill in the blanks (per payday). The “remaining balance” should be close to zero. I leave in a little extra cushion for online expenses.

How to calculate your zero-based budget: Each payday, add the total bills owed to the total from your budget worksheet. Deduct this amount from your income. The remaining amount should be put toward your debt snowball, leaving a zero balance. If there is little to none left or you are negative before adding money to the debt snowball, it’s time to take a look at your income and expenses because you’ll never get your debt paid off.

DON’T HAVE ENOUGH FOR A DEBT SNOWBALL? Do your cash budget & bills exceed your income? If so, you may need to make some adjustments. Once you’ve narrowed down your cash budget further, take a look at your bills. Do you really need cable or that smart phone? Look for ways to save money by cutting costs, selling some things, or even get a side job to make up the difference. These small sacrifices will pay off big time. Your goal is to have enough money left over to put a good amount towards you debt each payday. Paying the minimum amount each month will cost you a lot of money in the long run. Finance charges costs a fortune! So you want to get your debts paid off as soon as possible.

Purchase the GET OUT OF DEBT BUDGET KIT here.

Everyone budgets differently. The goal is to become better stewards of money and to live a debt free life. As Dave Ramsey says, “the borrower is slave to the lender”. Try out this system and if something doesn’t work for you, adjust it to fit your needs. Hopefully I have encouraged you to get on a written budget and pay down your debt! On Tuesday, I’ll go over how to use cash envelopes, so you can put your budget to work! Have a great week.

~Toni

Tags: budget, budgeting, Cultivating Financial Freedom, Dave Ramsey, debt free, debt snowball, sinking funds

Blog, Budget, budgeting, Cultivating Financial Freedom Series, finances, September 2016 Posted in

17 comments

Great post! Thank you for sharing. I have a question about the various categories you are saving funds in (car, car maintenance, house maintenance, etc)….are these separate savings accounts at your bank With these titles? Thanks so much, Amanda

I do keep separate savings accounts for car maintenance, car fund, household maintenance, etc. I have 12 savings accounts. 🙂

This is so awesome! Writing down my financial goals helps so much!

I just bought the packet of printable for the budget binder series that was on here before. Now I can’t find the series! Any way I can see that, since it corresponds with the downloads I got?

http://www.abowlfulloflemons.net/category/budget-binder-series

Which bank do you have your 12 savings acounts at? Im looking to start my sinking funds and im not sure which bank to use for the savings acounts. Thanks so much for this post!

Navy Federal Credit Union

I use Capital One 360. It is an online savings account where you can have many accounts, no minimums or fees and .75% interest rate. The downside is that you can’t withdraw your money immediately, it takes a few days.

Thank you for being there and walking us thru your process. My husband and I are working as a team to become financially independent. Thank you for all your help, advice and I love your support group on Facebook.

Great advice thank you !

Hi Toni- how are your planner tabs labeled for the last two Dave bundles? This is how I’ll use these bundles. Thanks!

My budget planner has 5 categories: Debt, Bank Accounts, Expenses (Bills), Sinking Funds, Budget.

I love this!!! I’ve needed the reminder to get back on track. Also could you please tell me the brand and color of the planner in your photos on this post? I adore it!!!

Thanks so much!!!

Its an original filofax. 🙂

Help. I ordered the wrong download. I wanted the budgeting download. I can’t find any way to contact you.

abowlfulloflemons at gmail dot com

This is so detailed I love it! I’m finally inspired to update my budget practices. Thank you for sharing!