As we continue our Cultivating Financial Freedom series, we’re moving on to part 3 – The Cash Envelope System. The cash envelope system is a way to manage your money that is conducive to saving. In place of credit or debit cards, you simply pay with cash. For some reason, when we do this, our brains tell us not to spend as much money. A red light goes on saying STOP – You don’t need to buy that. I have used this type of system on and off for several years and when I am on it, I save a noticeable amount of money. As I shared in our financial freedom journey last week, we made a goal to pay off our house in 2 years. So that means we are counting our pennies and living way below our means. The debit cards are out the window and we are a cash only family. We are serious about saving money.

IS THE CASH ENVELOPE SYSTEM RIGHT FOR YOU?

If you are short on cash each payday, want to pay down your debt, or just want to save more money, this system may be the answer. It’s straight forward and easy to follow! Try it for one month and see how much money you can save. If you haven’t created a written budget yet, visit this post and write one before starting the cash envelope system. Once you have your written budget, each payday you can add the allotted cash to you cash envelope wallet. Once the cash is gone, your spending is done for the payday! Be diligent and stick with the plan. It’s the only way it works.

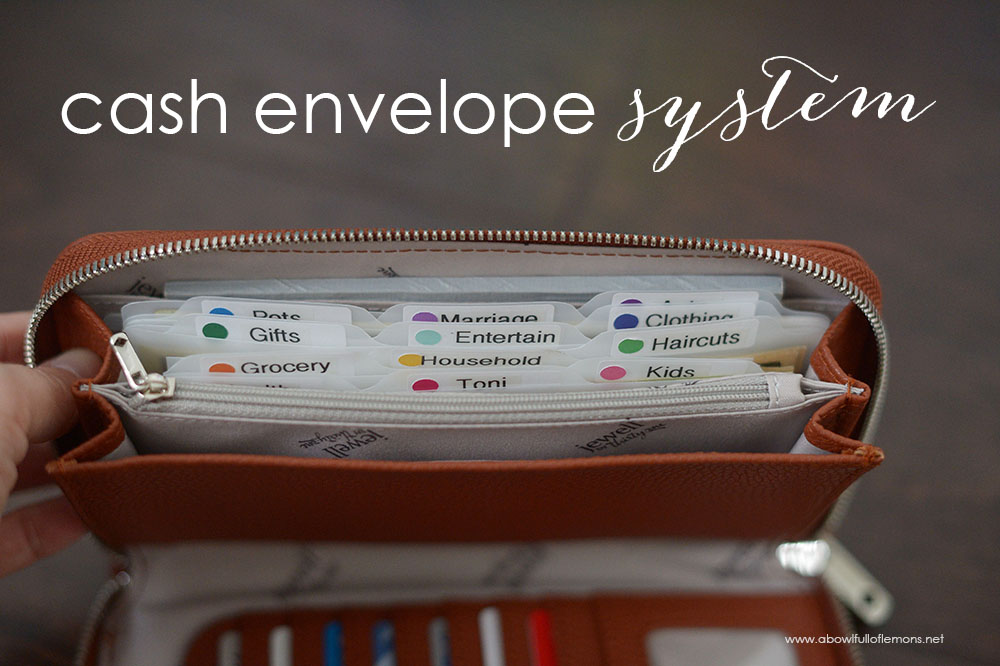

CASH ENVELOPE CATEGORIES: I have 12 categories in my wallet.

- Health – I have a sinking fund for this category but I do keep a small amount in my wallet. I use it to pay for prescriptions, over the counter medications, and co-pays.

- Toni – Personal Spending money.

- Kids – I keep a small amount for kids activities.

- Grocery – We budget $125 per week for groceries. Once it’s gone, it’s gone!

- Household – This category is for everything besides food (toilet paper, soap, etc).

- Haircuts

- Gifts – I have a sinking fund for this category but keep $25 in my wallet for times when my kids are invited to birthday parties. I budget $25 for each party invite. The rest of the gift budget remains in the bank (Holidays, Family Birthdays, Anniversaries, etc) and I withdraw it as needed.

- Entertainment – Movies, out to eat, festivals, etc.

- Clothing – I keep a small amount in my wallet and the rest in a sinking fund.

- Pets

- Marriage – This category is for date nights.

- Auto – I keep a small amount in my wallet and the rest in a sinking fund (car washes, oil changes, etc).

*We use our debit card to pay for gas.

DIVIDERS & DOT STICKERS: To categorize my cash, I use plastic dividers from A Time For Everything on Etsy. My color coded dots are also from Etsy. I used my label maker to label the categories.

WHICH WALLET SHOULD I USE?

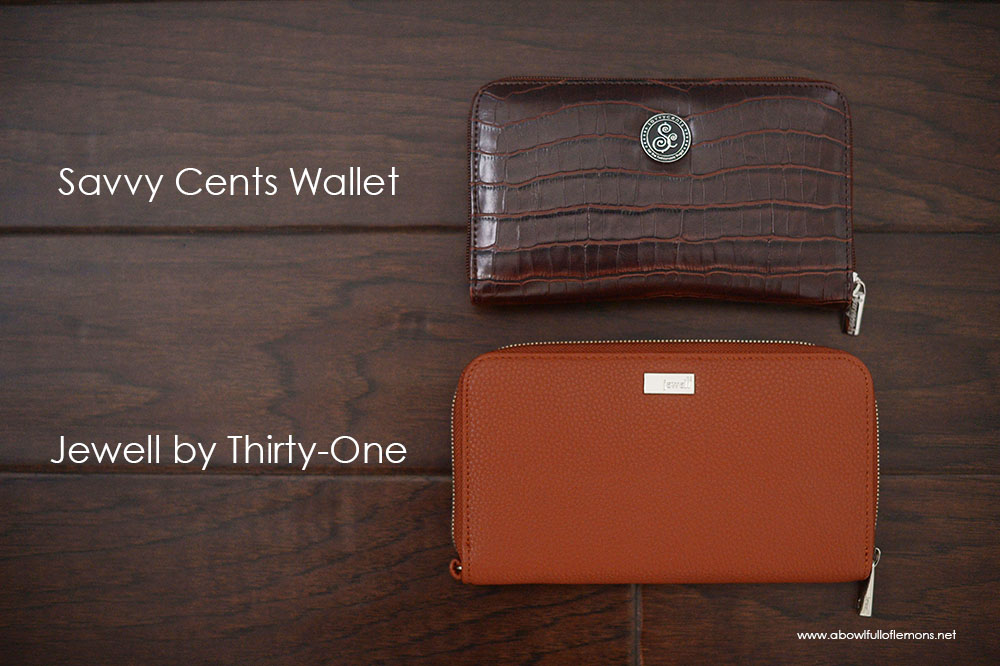

I am currently switching back and forth between my Jewell by Thirty-One “All About The Benjamins” wallet and my Savvy Cents wallet, which are the two most popular cash envelope wallets! I love them both. I will compare the two so you have a good idea of what each one has to offer.

ALL ABOUT THE BENJAMINS WALLET

The Jewell by Thirty-One “All About The Benjamins” Wallet is $48. It’s made of vegan leather. The wallet pictured is the color “cognac woods pebble”. It has 12 interior card pockets, an ID window, flat pocket for bills, zipper closure and a D-ring to attach a Wristlet Strap. It comes in 8 colors. The size is 4.75″H x 8″L x 1″D.

I also have the wallet in Gatsby Green. <3

The Savvy Cents wallet is slightly smaller but they both hold a lot. Each one has their own special features and they are both great wallets. You really can’t go wrong with either one.

THE SAVVY CENTS WALLET

The Savvy Cents wallet is $29.00 (+$3.95 shipping). It is made of synthetic material and comes in more than 8 colors and patterns (pictured below). The wallet shown is the color “brown”. It has an accordion stye file system that’s perfect for a cash envelope system. The wallet comes with pre printed and blank labels to customize the 5 sections. It has a loop for a pen. The wallet is 8″ x 4″. Get details and purchase here.

FREQUENTLY ASKED QUESTIONS ABOUT USING A CASH ENVELOPE SYSTEM

- How do I pay for more than one category in a single purchase? When you are placing your items up at the register, separate by category and pay for them separately. It only takes a few extra seconds and it will keep you organized.

- How do I make online purchases? Simply pay for the item using your bank account. Then go to your cash envelopes and remove the money from that specific category. Place the money in an envelope labeled “bank”. When it’s time to withdraw money out of the bank the next payday (to stuff your envelopes), take it from your “bank envelope” first.

- How do I easily keep track of my purchases while I’m shopping? After you pay, place the receipt in the designated category slot in your wallet. Once you get home, you can write down your purchases on your budgeted expenses form and deduct the amount from your category total on the budget worksheet (If you are keeping track). Keeping track holds you accountable for where your money is going. Trust me, it works!

If you missed any of our Cultivating Financial Freedom posts, click here. I’ll be back on Sunday for more budgeting tips!

Disclosure: There are affiliate links within this post. Thank you for your support to A Bowl Full of Lemons.

Tags: budget, budgeting, cash envelope system, Cultivating Financial Freedom, Dave Ramsey, finances

Blog, Budget, budgeting, Cultivating Financial Freedom Series, dave ramsey, envelope system, finances, September 2016, thirty one Posted in

43 comments

Hi, I am just starting this system and I am wondering what you do with the leftover money in each category. Do you just draw less from the bank the next month or do you deposit the extra back into savings?

Megan

If you have a lot of debt to pay off, transfer it to the next pays allotment. I budget well so don’t usually have too much left. I just keep it in the same envelope. If you have a lot of extra money left, readjust your budget.

Hi! I’m loving this series as budgeting and getting out of debt are a journey my husband I are just starting out on. My question about the envelope system may be silly, but I can’t wrap my head around it: how can we both go cash-only and have enough? Do we split it straight down the middle? Should only one of us (me) have a bunch of categories and the other have just a few?

Thanks!

When you write out your budget, figure out who should have each category (or split categories). I am the shopper in the family so I keep most of the cash. My husband only has his personal spending money and card for gas. If for some reason he needs to stop at the store, he will use his debit card and I will take the money out of the envelope and put it in the “bank envelope”. Hope this helps. 🙂

Hi Toni,

Could you tell me what a ‘sinking fund’ is please,

Many thanks

Carly

Hi Carly, I explained what a sinking fund is (in detail) here –> http://www.abowlfulloflemons.net/2016/09/create-a-written-budget.html.

Great Post and so interesting – wondering why you choose to use your debit card specifically and only for gas?! Also would like to hear your thoughts on responsibly using a cash back credit cards – I use my cash back card (pay in full every month) for all purchases I can and get approximately $1000.00 back in cash each year.

Thats just how we do it. Gas varies each week so its easier to just pay with card.

If you could ONLY pick ONE of these wallets, which would you choose? I really need to get on a cash budget and want to get the best wallet that will help me.

Thats hard. I really love the all about the benjamins wallet.

Also, should you carry your checkbook around or just leave it at home?

I keep it with me. It depends on how often you use it or need it.

I noticed you don’t have a an envelope for eating out. How do you manage eating out funds? Thanks.

I do have one. Its the ‘entertainment’ fund.

How do you keep the household money separate from the grocery money in practice? I like the idea of this (and want to do the same thing with baby diapers/wipes). I grasp the concept, but I shop for these items at the same stores, so I can’t figure out how to make this work in practice. For example, if you pick up toilet paper along with groceries, what do you do?

I keep them in separate categories and pay for them separately. Super easy to do.

If someone is not wanting to deal with cash in the wallet or a paper budget etc. I highly recommend You Need a Budget. It is also 0 based and allows you to set up categories and sinking funds like the envelope system. You can easily use cash, credit, debit with it. You go through an website to access it from your computer and it comes with apps so you can always have your budget/envelopes with you. There is even a free trial period.

It obviously won’t work for those who need to use only cash so they don’t cheat the system and it does cost (there are coupons occasionally), but for those like me it is wonderful. First time I have been able to budget and keep with it. So this is an option for those who want to try the 0 based budget, but the cash envelope system doesn’t work quite for them.

Really enjoying this series, particularly like the idea of your way to share in the budgeting. I can’t wait to start seeing a debts disappearing. Disappointed to go on the Thirty-One gifts website and see they don’t ship to the UK. I will have to go shopping for the perfect cash-only purse. I did buy one previously but it is too big and impractical for everyday use, so I use it for cash savings so its not all in the bank. Thanks 🙂

Check eBay for the wallets. Individual sellers may ship to the UK. I saw the Thirty One wallets listed. The prices are about the same as the online store but you may be able to get one that way. Good luck.

My grandmother was born in 1915. I’m not even sure if she had a credit card. All cash for her and no fancy wallet. She literally used envelopes. In fact, she usually reused an envelope from her mail. I wish I was fully there. I’m close and doing pretty well. It’s a great system.

I have loved using the Benjamins wallet for the cash system. I don’t use tabs so it’s more discreet when shopping. Here’s where I posted on Instagram my tip on using it five days ago.

https://www.instagram.com/p/BKHPTsPhze0/?taken-by=short_acres

short_acres

My paychecks are direct deposited. I normally pay everything with my debit card. Should I just figure out how much cash I spend and take it out of the bank and put it in my cash system?

Yes thats right!

I have been using this system for about 6 months now and as a family we have saved so much money. it made us more accountable with what we were actually spending. money can’t go “missing” from your budget if it’s not there in the envelope then it cant be spent. i also use an envelope system at home so i split all my bills in to their own envelope e.g. water, power, car rego etc. then each time I get paid i put the allocated amount of money in to the envelope, when a bill comes in I just take it out and go pay it. if we pay it online then i just put that money in to a “bank” envelope. and don’t withdraw as much next time I go to the bank.

So everytime you get paid you just basically take out the paycheck in cash as the bank and divide it into envelopes? I pay most of my bills online. Any advice on how this would work for me?

The bills come out electronically though my bank. All spending (groceries, household, entertainment, etc) comes out of cash.

Hi Toni.

The amazing All About The Benjamin’s wallet is not available in Australia and I am having trouble finding a decent alternative. Does Thirty -One gifts post to Australia because their usual checkout process doesn’t allow Australian zip codes or states. I’d love to buy through your party instead of Amazon if possible! Thanks, N

Nicole if you contact Charity, she is happy to order and ship it to you. Her email is charityrasmussen@yahoo.com.

Thanks for the series Toni! You have inspired me to start tracking expenses and to create a budget.

I have a few questions that maybe you could answer.

1. How do you create a budget if one spouse has a fluctuating income? Should I base it off of quarterly/yearly estimates?

2. If you are close to negative and have’nt created or contributed to sinking funds, should the debt snowball be implemented first (will obviously not be a fast way to pay down debt, just trying to not get overwhelmed and give up).

Other than food (which is where I am starting), I really don’t have a place to cut back on… No cable, no date nights, not a “shopper”, etc.

3. How do you budget $125 for weekly groceries? I meal plan but am nowhere near that – for a family of 4. Just curious if you could maybe share an example…

Again, thanks for inspiring others to work on their financial goals!!

Does the Benjamin Wallet come with the dividers? I can’t tell on the Thirty- One site.

Thank you!

No it doesn’t.

I have tried this before but what about a cash system for my husband? If he has to stop and pick up a grocery item or if he buys lunch? He doesn’t want to deal with keeping an organized wallet but if I give him a set amount to spend I don’t know how to categorize the money since it’s on a variety of things.

Give him the cash he is responsible for. IF he uses debit, take it out of the category.

Is there a zipper pocket for each section to hold the change? Or does it all go into the one zipper pocket?

One zipper.

Do you track your cash purchases or just use it til it’s gone?

And another burning question I have is for online purchases, say I buy something that qualifies as groceries from Amazon. I understand taking the cash from the groceries envelope and putting it in the bank envelope. Here’s where it gets fuzzy to me. Do i need to specifically use that very amount and place it in the grocery envelope at the first of the month or is cash cash and just use that bank envelope to fill my envelopes then complete with cash withdrawn. I hope that makes sense. im also trying to keep the reports straight in quicken so I think that’s what’s confusing me!

I track all purchases. When purchasing online and adding to bank envelope, use that money to fill all envelopes the next week. Not just the one you took from.

Hi – thanks for comparing these two wallet systems so well! I’m wondering about your color-coded dots…what do they mean and how do they help you?

Thanks!

Just different categories. 🙂

My grandmother and mother used this system. Mom used literal envelopes. Her mother used a cash box with compartments. I have also used it, had to when I was married. Now that I am retired, I’m thinking of going back to it.

Hey Toni- I’ve got another random question…do you shop in bulk at all, say at Costco? If so, how do you factor this into your weekly budget for groceries and household items (assuming you’re not at Costco weekly)? Thanks!!!

Thank you! I have tried the cash envelope system twice & fell off the wagon for a couple reasons. I am back to trying if. This post answers a few of the issues I was having. Thank you so much!

Have you found better inexpensive ideas for your cash flow envelopes? Spending $48 is a little high to me. Has anyone found a cheaper one at Walmart or one of the Office stores, etc? Thanks.