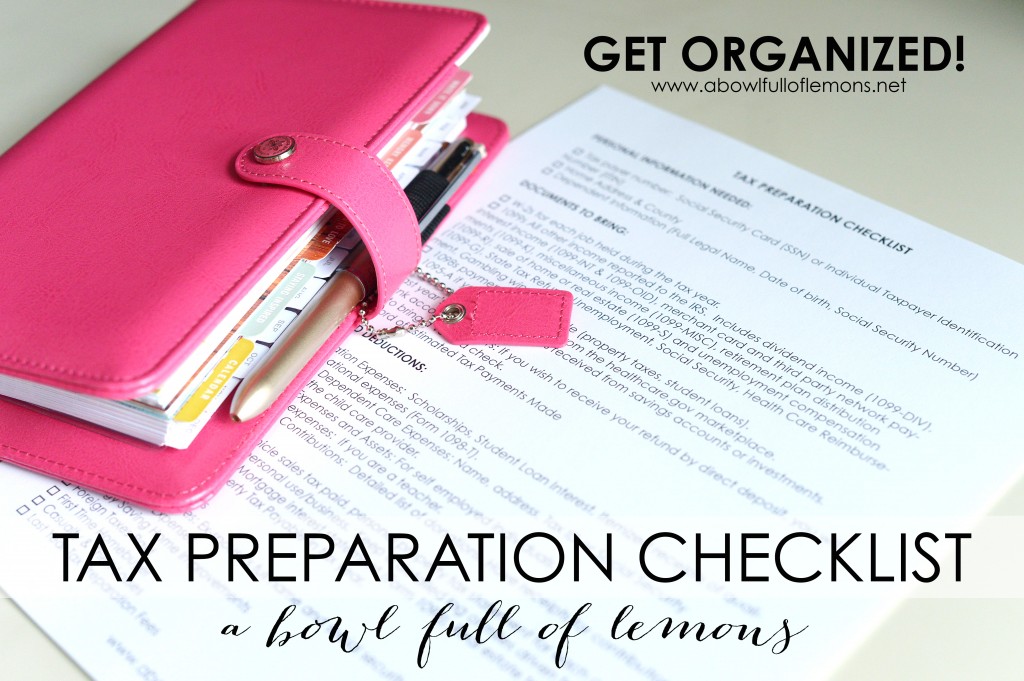

April 15th is arriving soon, so today I’m sharing a checklist of everything you’ll need to gather up, to file your income taxes. Print it out & get started early. You will need to gather up these documents whether you are filing yourself or if you’re having a professional do it for you. If you have any questions or need detailed information about filing your taxes, visit www.irs.gov/filing.

How do you know if you need a professional to help prepare and file your taxes?

If you have one job, don’t have any dependents (those are your kids!), and don’t have any deductions like charitable contributions, medical expenses, or work-related expenses, then you can probably do your taxes on your own. But once you start adding in your home business, kids, donations and other expenses, a good tax pro will make preparing and filing your taxes so easy!

Not sure where to look, to find a professional who can prepare your taxes? Dave Ramsey’s Endorsed Local Providers are professionally trained CPAs and Enrolled Agents all over the U.S. They are experienced, licensed pros who make sure you get every deduction you qualify for. You don’t have to stress over preparing your taxes on your own when there’s a professional out there who can take the tough work out of taxes. You can find the tax pro Dave recommends in your area HERE. They’ve also put together this Tax Q&A website that answers questions like “Are there any tax deductions for working from home?” “What do I do if I can’t afford to pay my taxes?” and “Do we get a tax credit for a new baby?”

So what do you need to take to your meeting with a tax pro? Here’s my checklist.

PERSONAL INFORMATION NEEDED:

- Tax payer number: Social Security Card (SSN) or Individual Taxpayer Identification Number (ITIN)

- Home Address & County

- Dependent Information (Full Legal Name, Date of birth, Social Security Number)

DOCUMENTS TO BRING:

- W-2s for each job held during the tax year.

- 1099s All other income reported to the IRS. Includes dividend income (1099-DIV), interest income (1099-INT & 1099-OID), merchant card and third party network payments (1099-K), miscellaneous income (1099-MISC), retirement plan distribution (1099-R), sale of home or real estate (1099-S) and unemployment compensation (1099-G), State Tax Refund, Unemployment, Social Security, Health Care Reimbursement, Gambling winnings.

- 1098s payments you’ve made (property taxes, student loans).

- 1095-A if you received credit from the healthcare.gov marketplace.

- Income or interest statements received from savings accounts or investments.

- Last year’s tax return

- Bank account numbers: If you wish to receive your refund by direct deposit, you will need to bring a voided check.

- Record of Estimated Tax Payments Made

ITEMIZED DEDUCTIONS:

- Education Expenses: Scholarships, Student Loan Interest, Itemized receipts of qualified educational expenses (Form 1098-T).

- Child & Dependent Care Expenses: Name, address, Tax ID or Social Security Number of the child care provider.

- Business Expenses and Assets: For self employed individuals.

- Educator expenses: If you are a teacher.

- Charitable Contributions: Detailed list of donations. Have receipts for contributions over $250.

- Vehicles: Vehicle sales tax paid, personal property tax statement for each car, total miles driven for personal use/business. Keep a detailed log of miles driven for business.

- Homeowners: Mortgage interest statement (Form 1098), Real estate taxes paid, Statement of Property Tax Payable in tax year.

- Retirement/IRA: Amount contributed to an IRA and total value as of December of tax year.

- Moving Expenses

- Alimony Expenses: Ex-spouse’s full name and social security number.

- Healthcare Expenses

- Energy Saving Home Improvements

- Foreign Taxes Paid

- First Time Homebuyer

- Casualty & Theft Losses

- Last Year Tax Preparation Fees

*This list is an overview of the most used tax deductions/documents. Please refer to the IRS website for the complete list.

Print out the FREE checklist here.

Are you having a hard time finding the documents you need from the tax preparation checklist? If so, here are a few tips to help you get organized & stay organized for tax season.

Disclaimer: This is a sponsored post by Ramsey Solutions. All opinions are my own & I only recommend products or services I use personally and believe my readers will enjoy. I am disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 255: “Guides Concerning the Use of Endorsements and Testimonials in Advertising. Please click here for full disclaimer. Note: I am not an accountant. I am not responsible for your taxes. You will need to speak to an accountant for questions related to your taxes.

Tags: Dave Ramsey, finances, free printable, taxes

Blog, dave ramsey, finances, Free Printable, January 2015, Office, Organize, Tax preparation Posted in

6 comments

Sharing this Toni, what a great resource. Thanks!

I kind of get excited for taxes. Am I the only one? This might be the last year we do them on our own though…a baby is on the way.

You might be the only one although I always get excited about the refund check! Congrats on the baby!!

I always dread tax season. But I love a good checklist! Thanks for sharing this wealth of information about tax preparation. I’m pinning this now. It will definitely come in handy when I get started on my taxes.

What kind of agenda is the pink one at the top?

I NEED to know what kind of planner that is in the photo! Love it! I love my planner, but I can’t seem to find the right binder/planner to keep it in.