5 Financial Books Everyone Should Read

Cultivating Financial Freedom begins with the person looking back at you in the mirror. The decisions you make determine your future and what you choose to read, watch, and surround yourself with all have a major influence on your financial life. So you must choose wisely. These 5 books have greatly influenced my Read More

10 Simple Ways to Save Money

Stretching your weekly budget and getting out of debt takes creativity and will power. The little things you do every day will determine whether or not you will succeed. Here are 10 simple ways to save money so your budget will go further and you can finally get out of Read More

The Cash Envelope System

As we continue our Cultivating Financial Freedom series, we’re moving on to part 3 – The Cash Envelope System. The cash envelope system is a way to manage your money that is conducive to saving. In place of credit or debit cards, you simply pay with cash. For some reason, Read More

Cultivating Financial Freedom

Welcome to A Bowl Full of Lemons. During the month of September, I will be sharing our journey towards financial independence and hopefully inspire you to do the same. But before I begin, I must warn you that I am not a financial advisor and my college degree doesn’t have anything Read More

Tax Preparation Checklist

April 15th is arriving soon, so today I’m sharing a checklist of everything you’ll need to gather up, to file your income taxes. Print it out & get started early. You will need to gather up these documents whether you are filing yourself or if you’re having a professional Read More

Periodically Reworking Your Budget

You’re following a written budget – fabulous! You are totally on the right track.* But one of the facts of life is that nobody’s financial situation is static. There are fluctuations in income, new expenses, expenses that end, and changes in monthly bill amounts. Plus, children are born, Read More

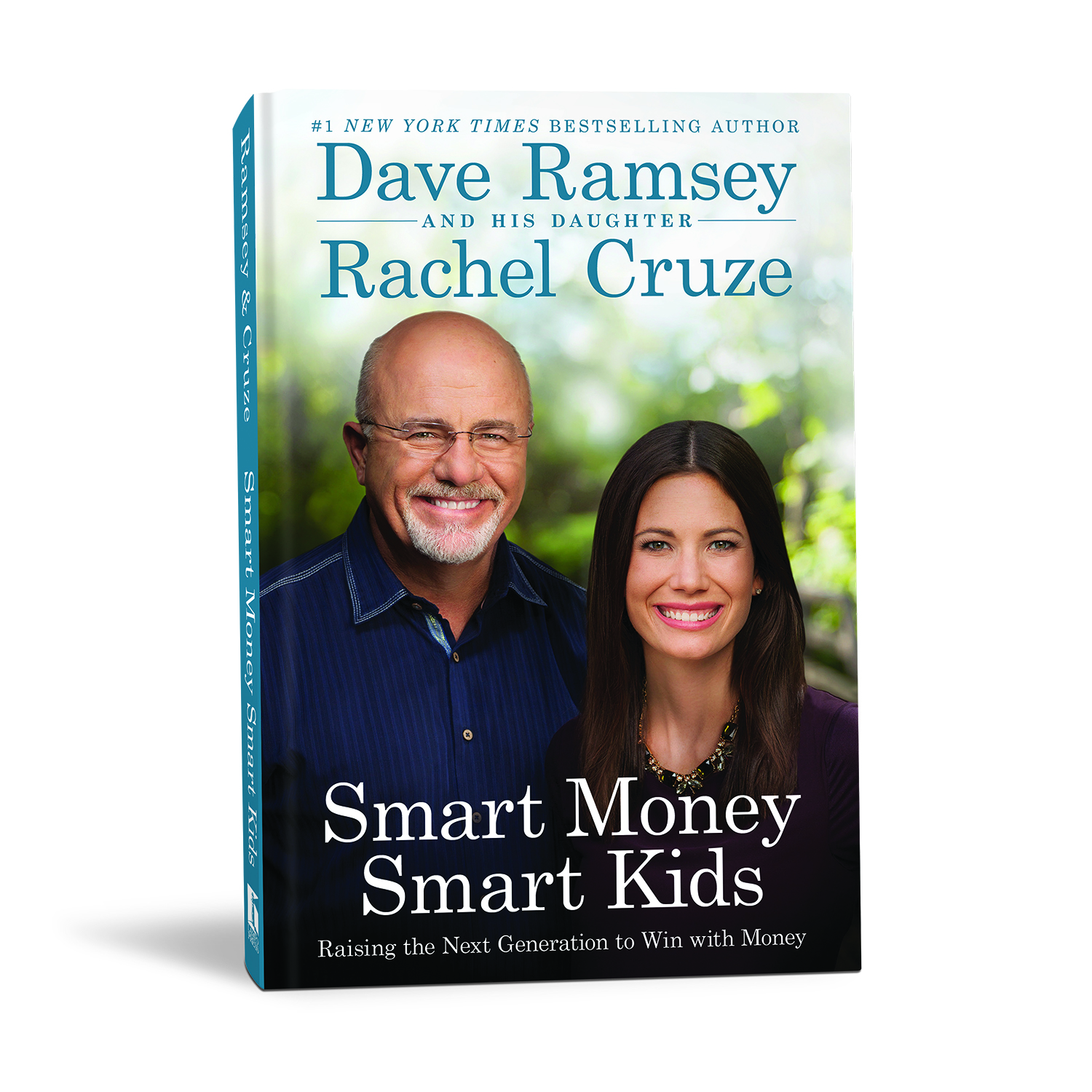

Smart Money Smart Kids…

Are you a parent who has yet to teach your children about money? Raising kids is scary and teaching them about money can be even scarier. This concept is forgotten among most families these days. Our kids are taught the dangers of drugs and alcohol, not to put their fingers Read More

Saving Your $1,000 Emergency Fund

via freedigitalphotos.net When you feel as though you’re living paycheck to paycheck, the thought of building up a $1,000 emergency fund can be daunting. But it’s so important, and with a little creativity it can be a fun and rewarding challenge! However, those dollars will not accumulate without a plan. Read More

Don’t Take a Vacation From Your Budget!

Going on vacation is often the undoing of budgets in the summer months, but it doesn’t have to be that way! Here are some tips for helping you stick to a spending plan when you’re off having fun. Scope out deals ahead of time. If you know Read More

Budgeting Giveaway…

For the last 5 days, I have taught you how to organize a household budget, by setting up a Budget Binder. Day #1 – Assemble your Binder Day #2 – Record of Accounts & Monthly Due Date Schedule Day #3 – Income & Debt Tracking Day #4 – Annual Read More